CVA (Credit Valuation Adjustment) = market value of counterparty credit risk

Recent high levels of CDS spreads make CVA an important quantity in valuation of OTC derivatives.

Before, the same interest rate swap would have the same value for two different counterparties, while now , the same swap would have different price , depending on credit rating of the bank’s client and portfolio of exiting derivatives.

what is CVA?

CVA= (value portfolio taking into account counterparty credit risk)- (value of risk-free portfolio).

in simplified form it’s equivalent to Exposure to default * probability of default * Loss given default

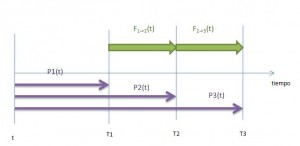

Exposure to default (EAD) = non-negative market value of portfolio at time of default , usually is calculated using monte carlo techniques

probability of default could be estimated from market CDS prices (or OAS spread of bonds)

LGD is based on expected recovery in case of counterparty default (in simple case it’s just (1-Recovery) Recovery is usually set to 40% )

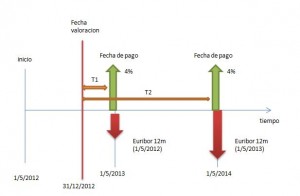

example

let’s take interest rate swap with notional 100 euros , maturity in 5 years , coupon of 1% (near market)

it’s risk-free price would be around 0.36 euros

when counterparty is tier-1 European bank counterparty CVA would be 0.10 eur (supposing we have no other OTC derivatives with Santander)

while when counterparty is tier-2 bank CVA would be around 0.25 eur , therefore Credit Risk adjusted value almost doubles the original risk free fair-value

(calculations of sept 2012, for spanish banks)

deploying CVA

Deploying CVA implied changes in valuation systems, introduction of new systems of CVA pricing and risk-management, and in appropriate case, creation of CVA desk

CVA desk

For managing and aggregating efficiently Counterparty risk many banks have created CVA desk: trading desk which centralizes managing of Counterparty Credit Risk (CRR) for all other trading desks (equity OTC derivatives desk, fx OTC derivatives desk etc).CVA desk charges a fee for this management . and these fees normally would be passed onto banks clients. once all these risks a aggregated CVA desk hedges the exposure with CDS contracts or Credit indices contracts (iTraxx for example)

possible deploing difficulties

CVA required very complicated calculations which needs powerful IT systems.It’s of great importance especially for Front Office which need to get CVA charge in real time (incremental CVA).Normally this would require highly parallelized grid systems.

Another heavy calculation step is obtaining CVA greeks which wold also require grid system.

Problems can arise while integrating 3 systems into one – portfolio data with each client, real time market data, netting agreements with clients)

For probabilities of default calculations one needs liquid CDS market which only exists for some counterparties, otherwise CDS proxies are needed.

wrong-way risk arises when counterparty exposure is highly correlated with CDS spread, for example in case of short CDS position.in this case one needs to complicate the calculations with correlations beween credit risk and other market variables.

also CVA calculation system would need to take into account Basel III requirements as some hedges are not eligible under Basel 3.

financial impact?

during financial crisis almost 70% of CCR losses were attributed to CVA losses and only 30% were attributed to actual defaults (Basel comitee)

recently JP Morgan declared losses of over 2bn$ in it’s division responsible for CVA hedging

goldman sachs could have a overall negative exposure to AIG thanks to it’s CVA desk

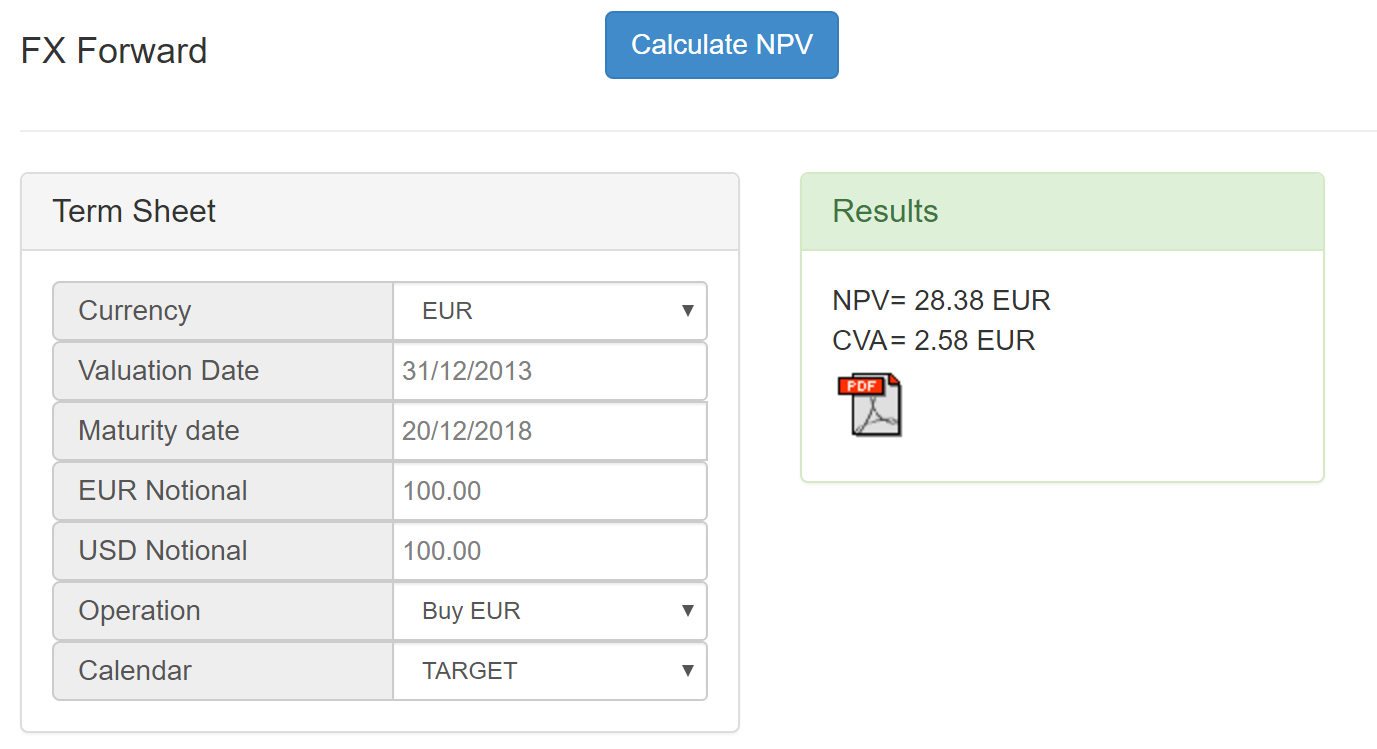

CVAvaluation systems

global banks have spent over 900MM$ in systems supporting CVA

![[<<] PriceDerivatives blog](https://www.pricederivatives.com/en/wp-content/uploads/2014/03/cropped-pricederivatives-blog-logo-Copy3.png)