Libor in arrears

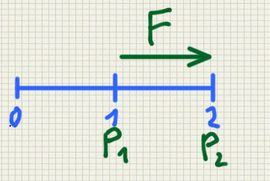

simplified Libor in arrears payoff: pay at time 1 1-year Libor reset at time 1 F(1)

$$ \frac{NPV(0)}{P_1(0)}=\mathbb{E}^1 (\frac{F(1)}{P_1(1)}) $$

where $$\mathbb{E}^1$$ is measure with numeraire $$P_1(t)$$

change measure from time 0 to time 1 (time while F(t) is changing)

with girsanov formula :

$$ \frac{P_1(0)}{P_1(1)}dP_1=\frac{P_2(0)}{P_2(1)}dP_2 $$

so we get

$$ NPV(0) = P_2(0) E^2 ( \frac{F(1)}{P_2(1)})$$

but $$ \frac{1}{P_2(1)}=1+F(1) $$

so $$ NPV(0)=P_2(0)\mathbb{E}^2(F(1))+P_2(0)\mathbb{E}^2(F^2(1)) $$

under $$\mathbb{E}^2$$ F(1) is martingale i.e. $$\mathbb{E}^2 F(1)= F(0)$$

to calculate $$\mathbb{E}^2(F^2(1)) $$ we must introduce dynamics for F(1)

for example black-scholes where under $$\mathbb{E}^2$$ : $$dF(t)=\sigma F(t) dW_t$$

so $$ F(1)=F(0) e^{\sigma W_1 – 0.5 \sigma^2 } $$ and therefore

$$ \mathbb{E}^2 F^2(1)=F^2(0) e^{-\sigma^2 } \mathbb{E}^2 e^{2 \sigma W_1 } = F^2(0) e^{\sigma^2 } $$

for CMS convexity adjustment use linear model i.e. $$ \frac{P_{->T_{mat}}}{Annuity}=A+B(T_{mat})*Swaprate $$

libor in arrears will depend on volatility as at time 1 we can reinvest this cashflow with rate F obtaining at 2 F(1+F)=F+F*F which is a nonlinear smooth function so can be decomposed into Forward plus portfolio of caplets which depends on vol

![[<<] PriceDerivatives blog](https://www.pricederivatives.com/en/wp-content/uploads/2014/03/cropped-pricederivatives-blog-logo-Copy3.png)