Amortizing interest rate swap valuation excel with 2 curves example:

for online amortizing interest rate swap valuation with credit valuation adjustment see Online Amortizing Interest rate swap valuation with CVA and OIS discounting

for quantlib python version see Amortizing Interest rate swap valuation with python quantlib

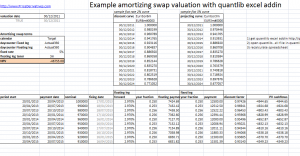

In this example we value amortizing swap with 2 flat curves : discount curve and forwarding curve.

You can get curves in this format on Bloomberg or Reuters terminals.

to get real value of swap paste curves for your valuation date and adjust arguments in formulas.

set appropriate daycount conventions (usually actual/360 or 30/360) and calendars (usually TARGET in European contracts) from termsheet.

1) first install quantlib addin at http://quantlib.org/quantlibxl/ -> download

2) open file at QuantLibXL\xll\QuantLibXL-vc90-mt-s-1_2_0.xll

3) open spreadsheet ctrl-alt-f9 to recalculate all

for quantlib c++ valuation see http://www.pricederivatives.com/en/how-to-value-swap-with-2-curves-with-quantlib-quantlib-swap-example/

![[<<] PriceDerivatives blog](https://www.pricederivatives.com/en/wp-content/uploads/2014/03/cropped-pricederivatives-blog-logo-Copy3.png)