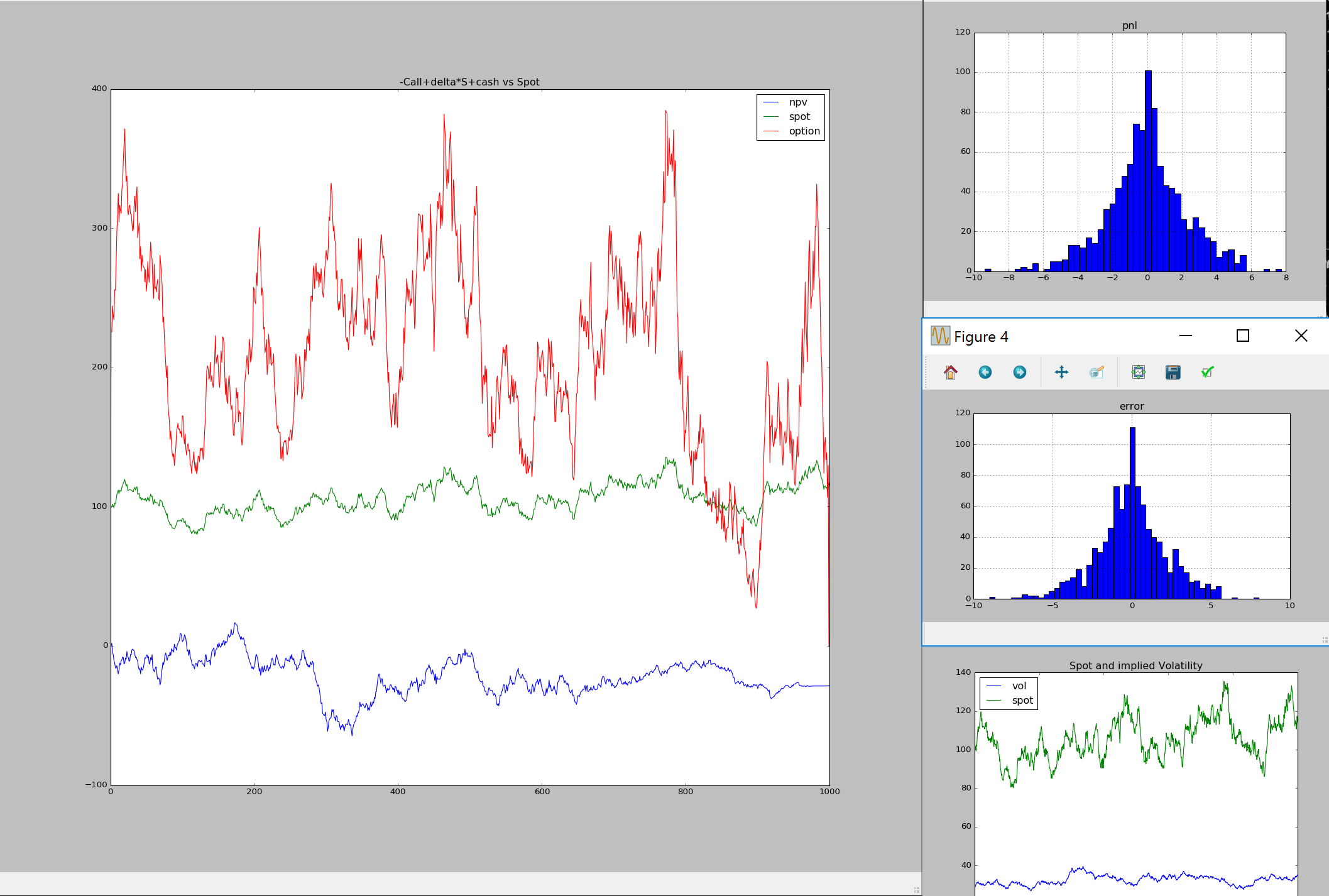

Here we will present simple python code of delta hedging example of a call option .

it’s a minimal example with zero interest rates , no dividends. On day 1 we sell 10 near ATM call options and start delta hedging i.e. buying/selling stock so that change in stock price neutralizes change in options value.The portfolio is then $$\pi= delta*Stock-callOption+cashAccount$$

to simulate stock prices we will use log-normal dynamics $$ \frac{dS_t}{S_t} =\sigma_t dW_t $$

We will also simulate implied volatility as log-normal $$ \frac{d\sigma_t}{\sigma_t}=\xi dB_t $$

each day of simulation we will store in DataFrame df , so it will be easy to print and plot with pandas library.

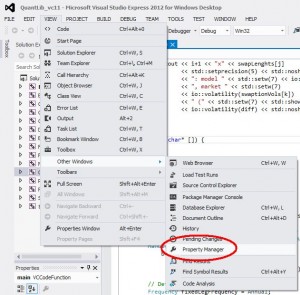

to run the python code you will need pandas library installed in your distribution

apart from usual NPV of hedging portfolio and values of call option and greeks we will also display P&L prediction which is $$ PNL \approx \frac{\Gamma}{2} (dS)^2 + \theta dt $$

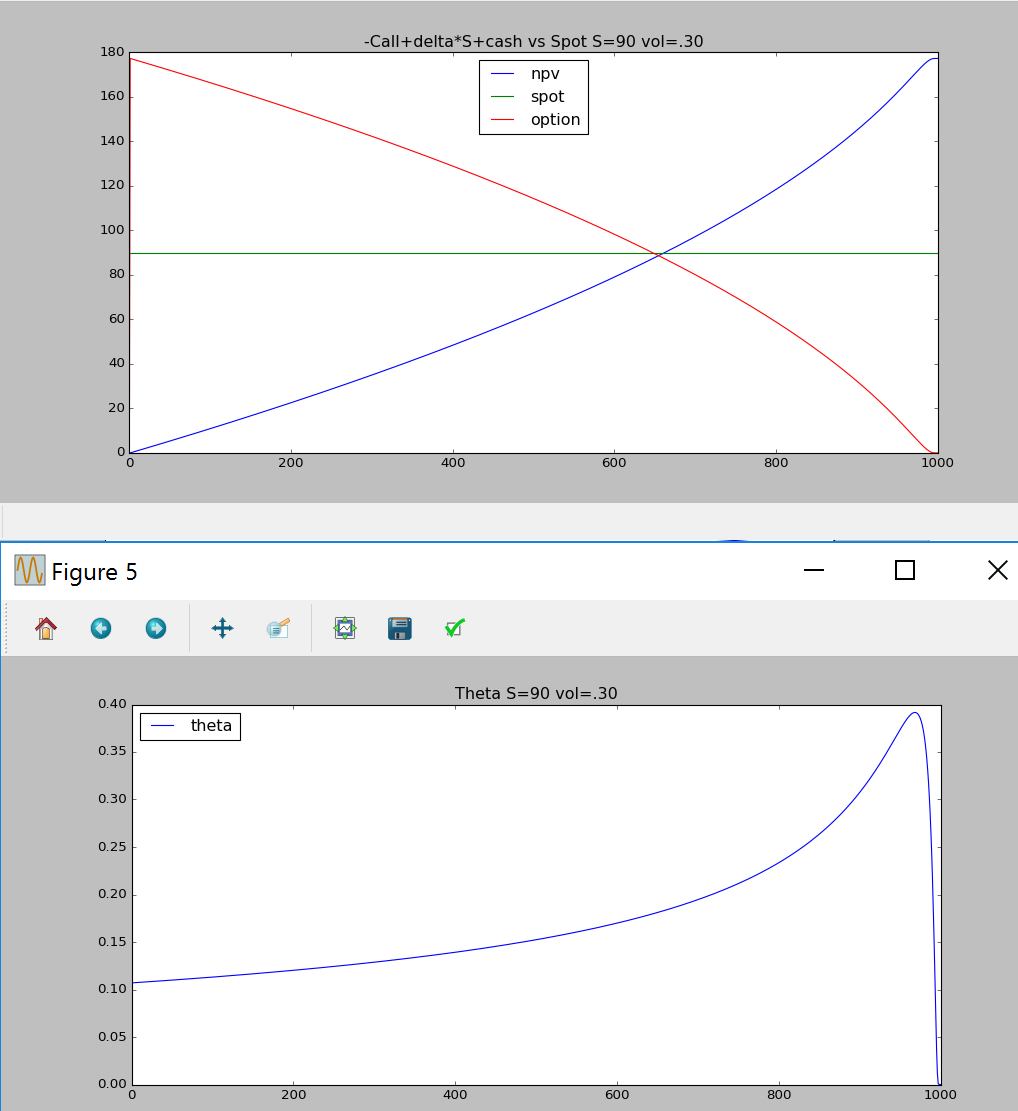

delta hedging simulation

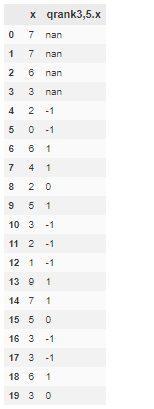

first 10 days of delta hedging:

spot vol shares cash option npv vega gamma theta pnlPredict pnl error

0 100.00 30.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 nan nan

1 102.89 29.83 6.35 -401.20 252.38 0.00 -772.52 -0.06 0.12 -0.14 0.00 0.00

2 103.65 29.89 6.40 -406.13 257.56 -0.36 -774.36 -0.06 0.12 0.10 -0.36 -0.46

3 98.00 29.34 6.02 -368.79 218.14 2.91 -754.75 -0.07 0.11 -0.96 3.27 4.23

4 96.83 29.61 5.95 -362.24 213.06 0.93 -748.61 -0.07 0.11 0.06 -1.98 -2.04

5 95.76 29.35 5.86 -353.97 204.68 2.96 -743.77 -0.07 0.11 0.07 2.03 1.96

6 95.40 28.75 5.81 -348.68 198.03 7.53 -742.86 -0.07 0.11 0.10 4.57 4.46

7 94.12 28.71 5.71 -339.71 190.26 7.85 -735.94 -0.07 0.11 0.05 0.32 0.28

8 94.28 27.96 5.69 -336.97 185.56 13.47 -737.79 -0.07 0.10 0.10 5.62 5.52

9 95.42 27.56 5.75 -343.04 189.00 16.52 -744.17 -0.07 0.10 0.05 3.05 3.00

10 96.53 28.02 5.85 -353.01 198.72 13.16 -748.41 -0.07 0.11 0.06 -3.36 -3.42

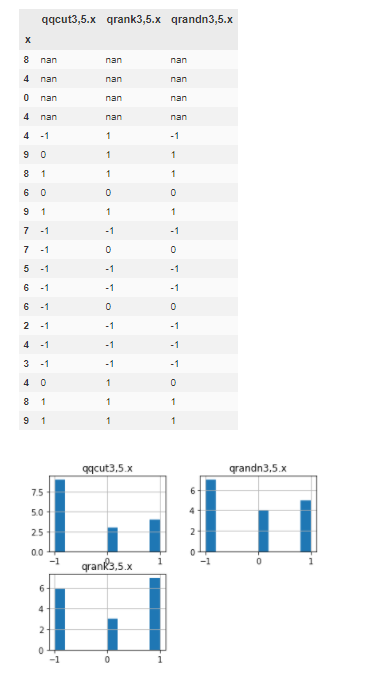

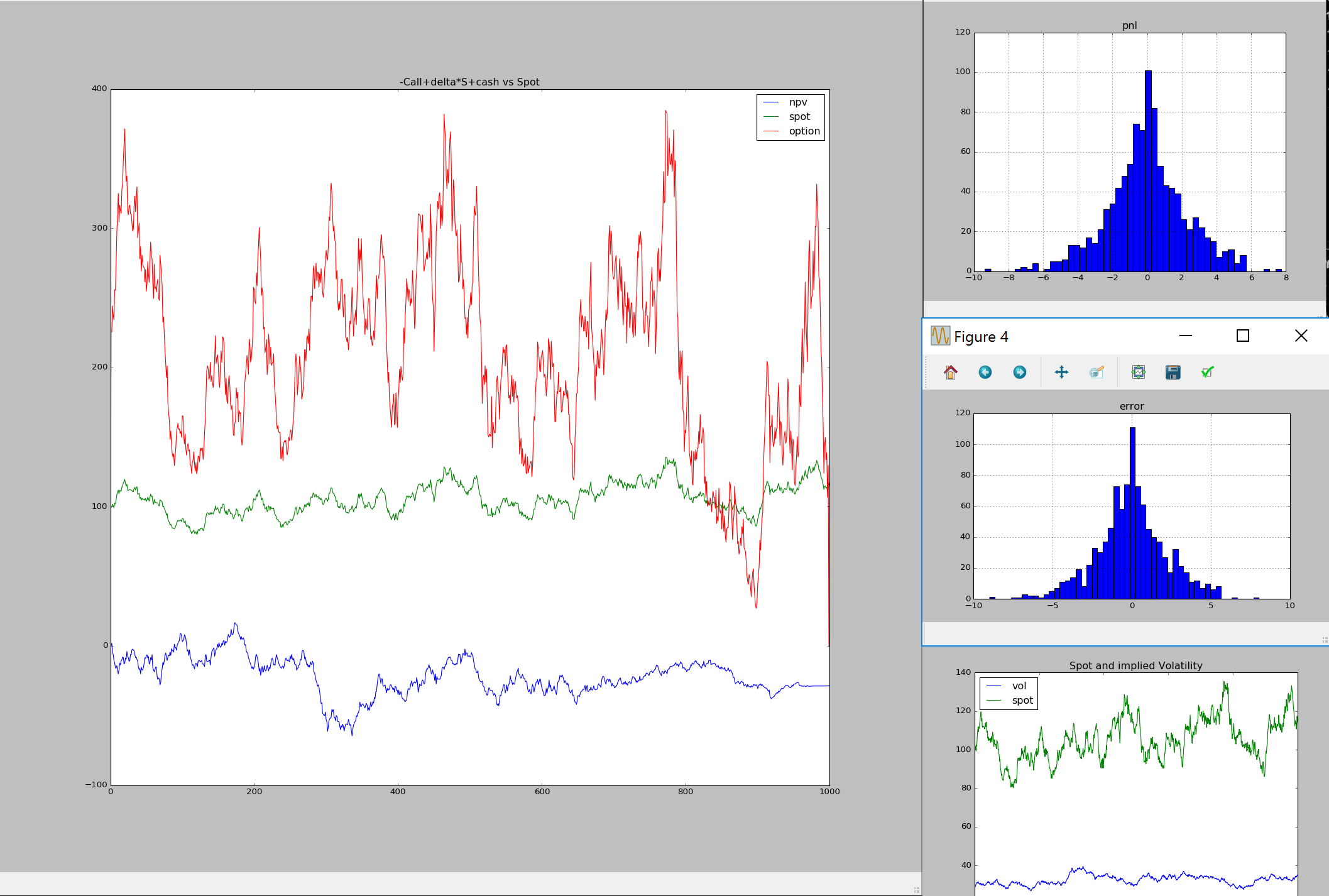

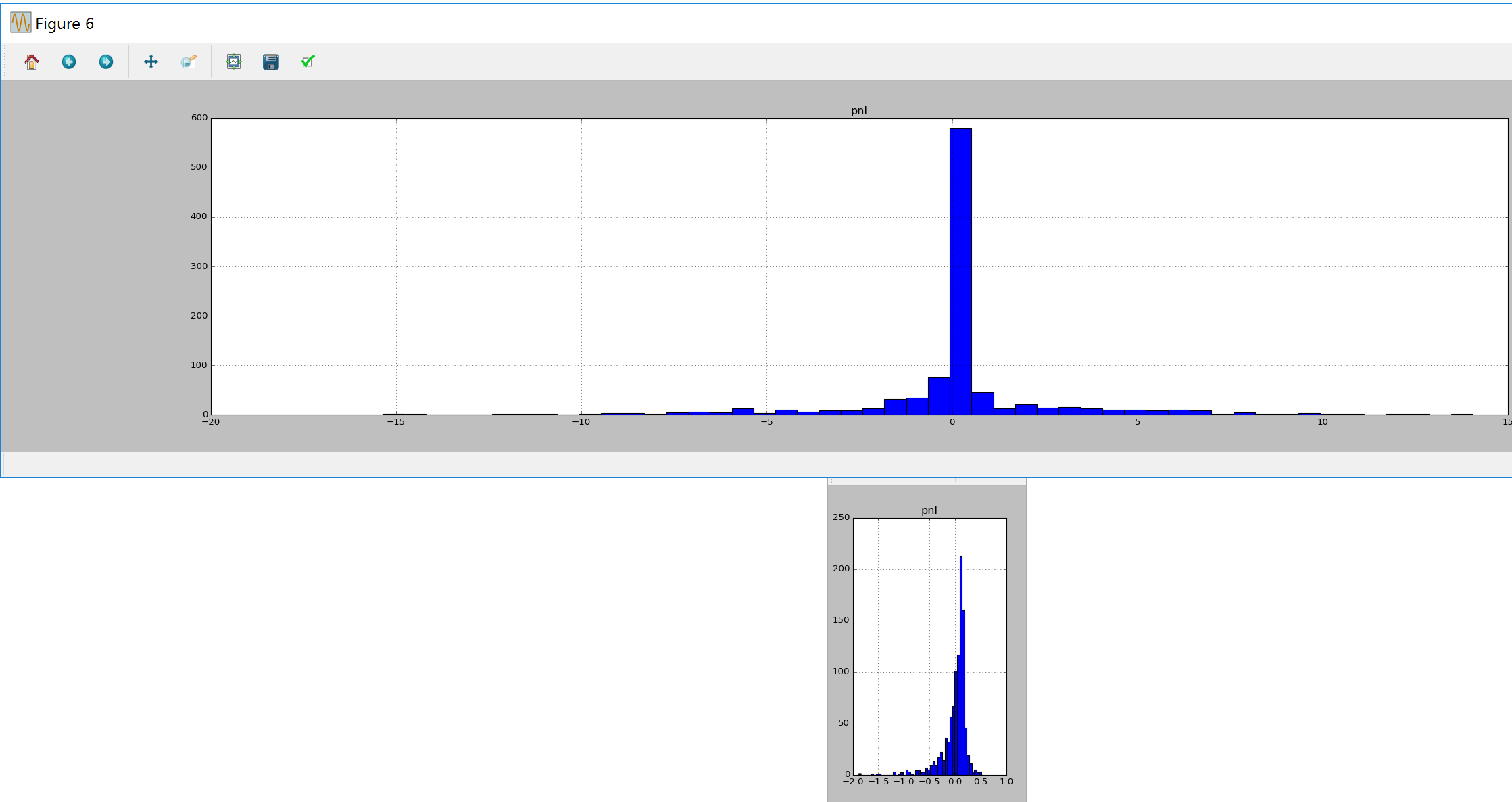

P&L profile

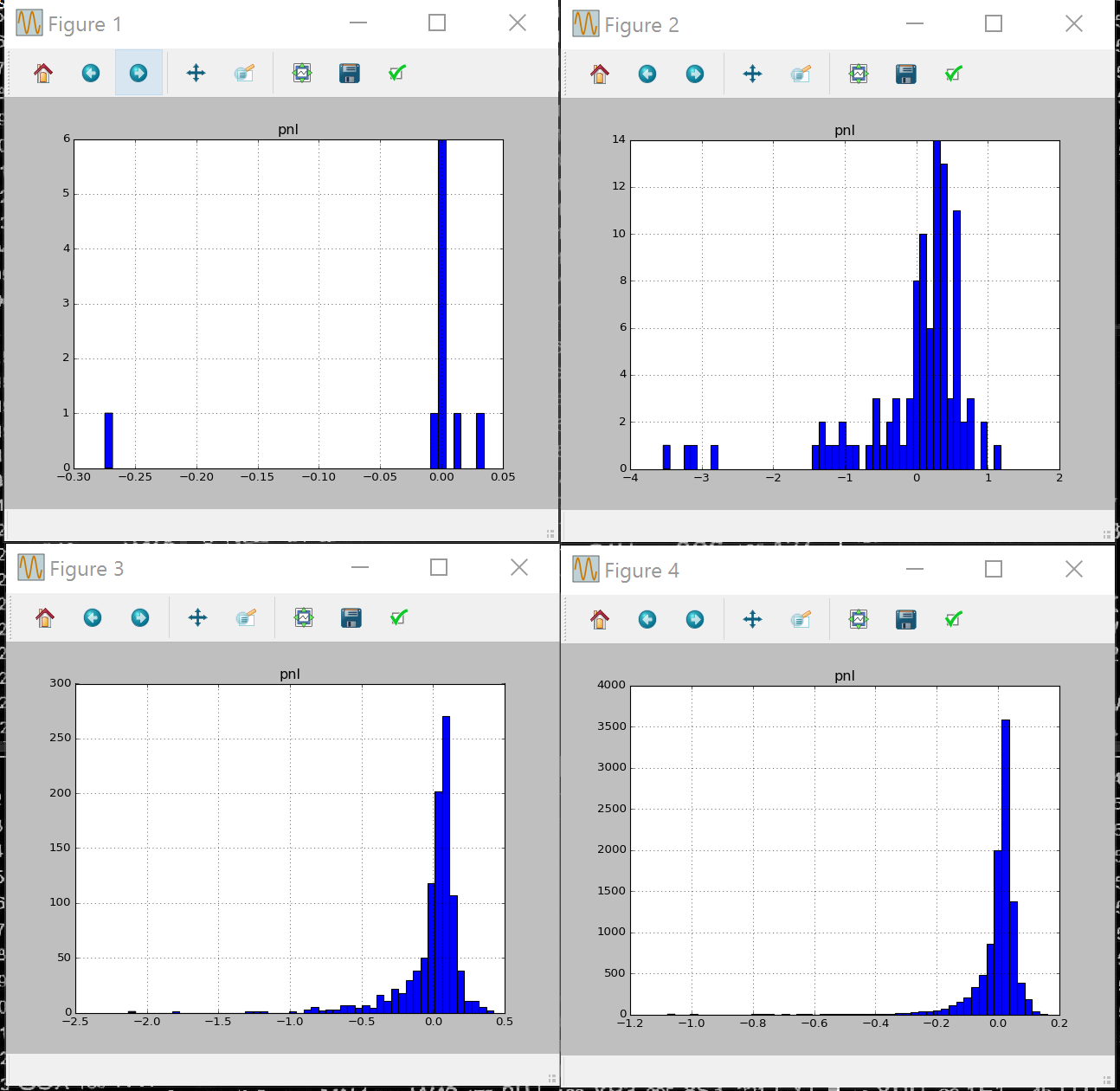

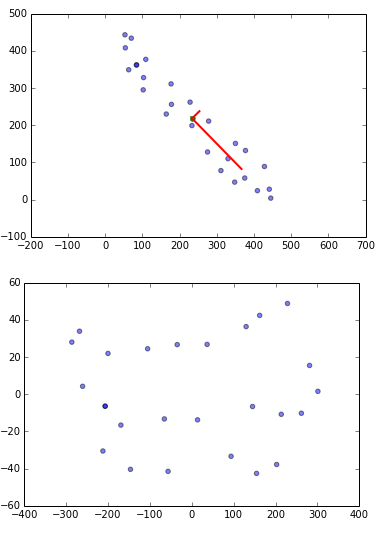

running this code for number of days 10,100,1000,10000 we can see P&L profile start to look narrower and more centered at 0 with number of days , in the limit of infinite days (equivalent to infinite frequency of hedging of Black Scholes assumptions) it would look like a dirac function.

pnl profile delta hedging 10 100 1000 10000 days

Why is it skewed to the left? as Gamma is always negative and high near ATM, if there’s jump down, PNL is proportional to gamma * jump size $$ PNL \approx \frac{\Gamma S^2}{2}((\frac{dS}{S})^2-\sigma^2)$$ and delta makes a high decrease, so we would need to sell many shares cheap. In case there’s a jump up, we would still need to buy more stock (as delta of call option goes up), so still would loose money in this case.That makes the daily PNL profile asymmetric.

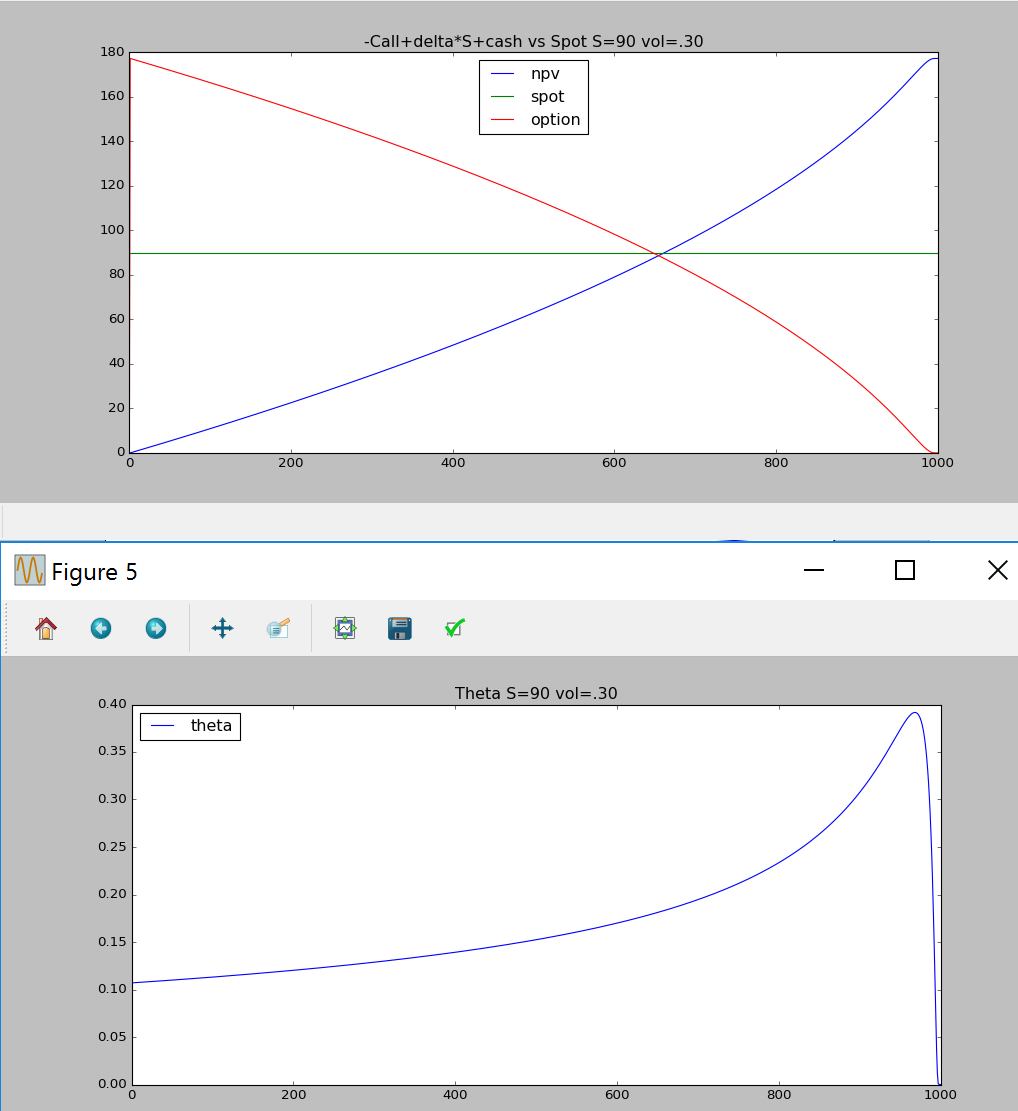

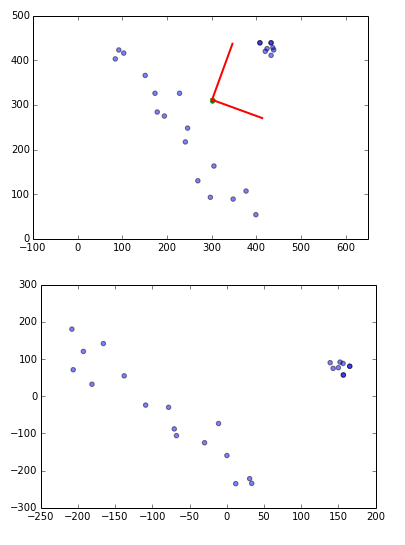

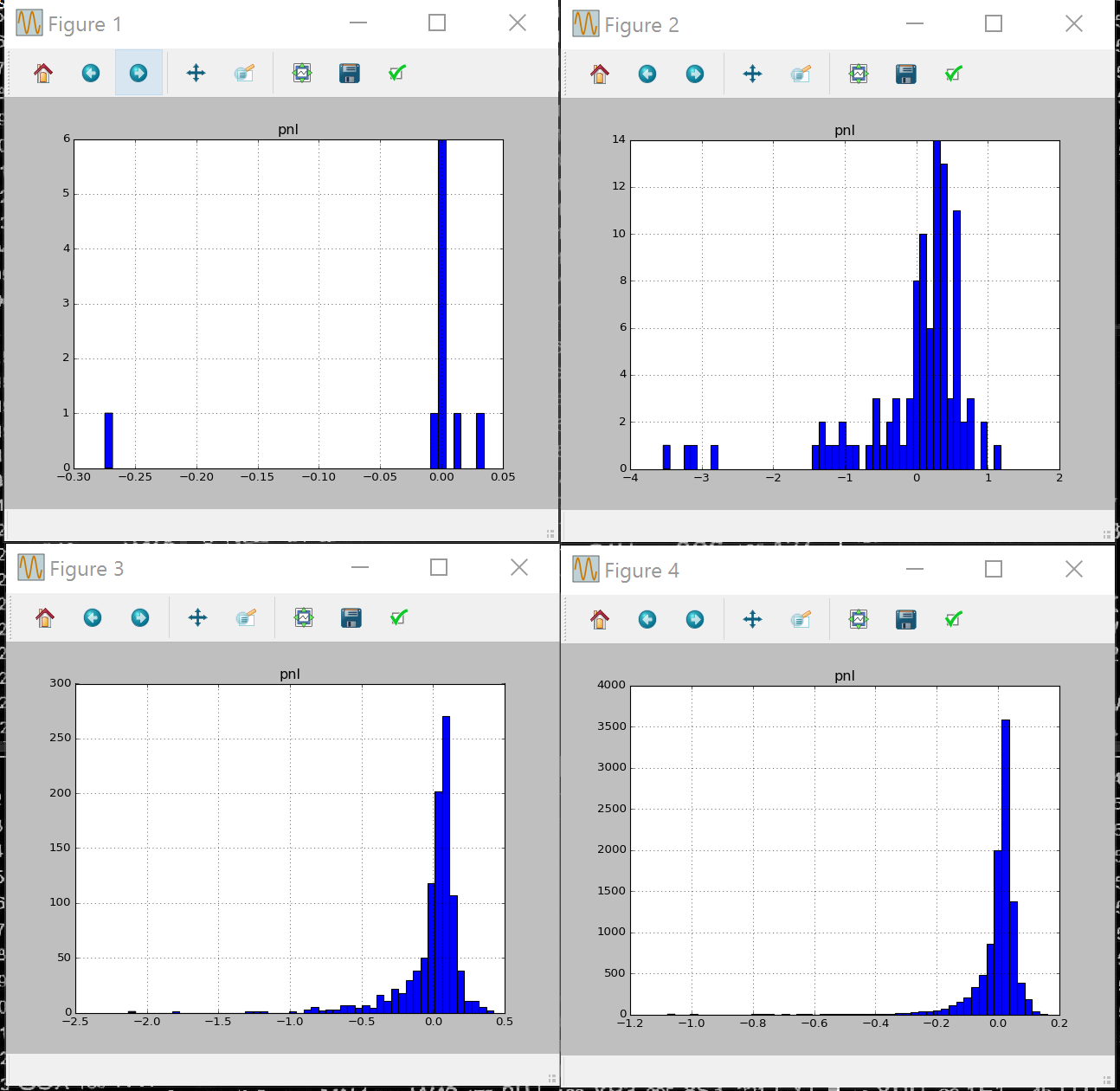

Theta

setting Spot prices constant in the code we can see the Theta effect on the hedging strategy:

here’s the example of running the python code with constant Spot:

theta OTM delta hedging constant spot

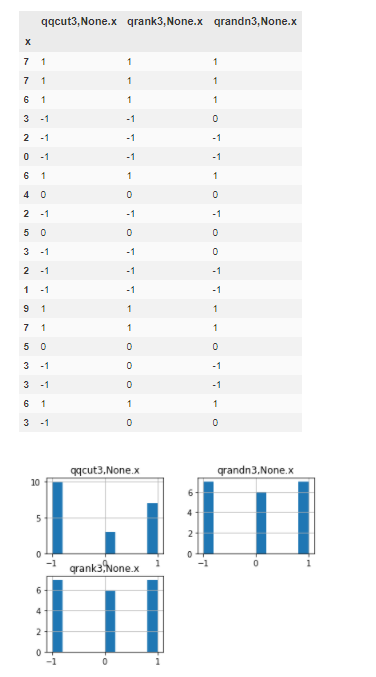

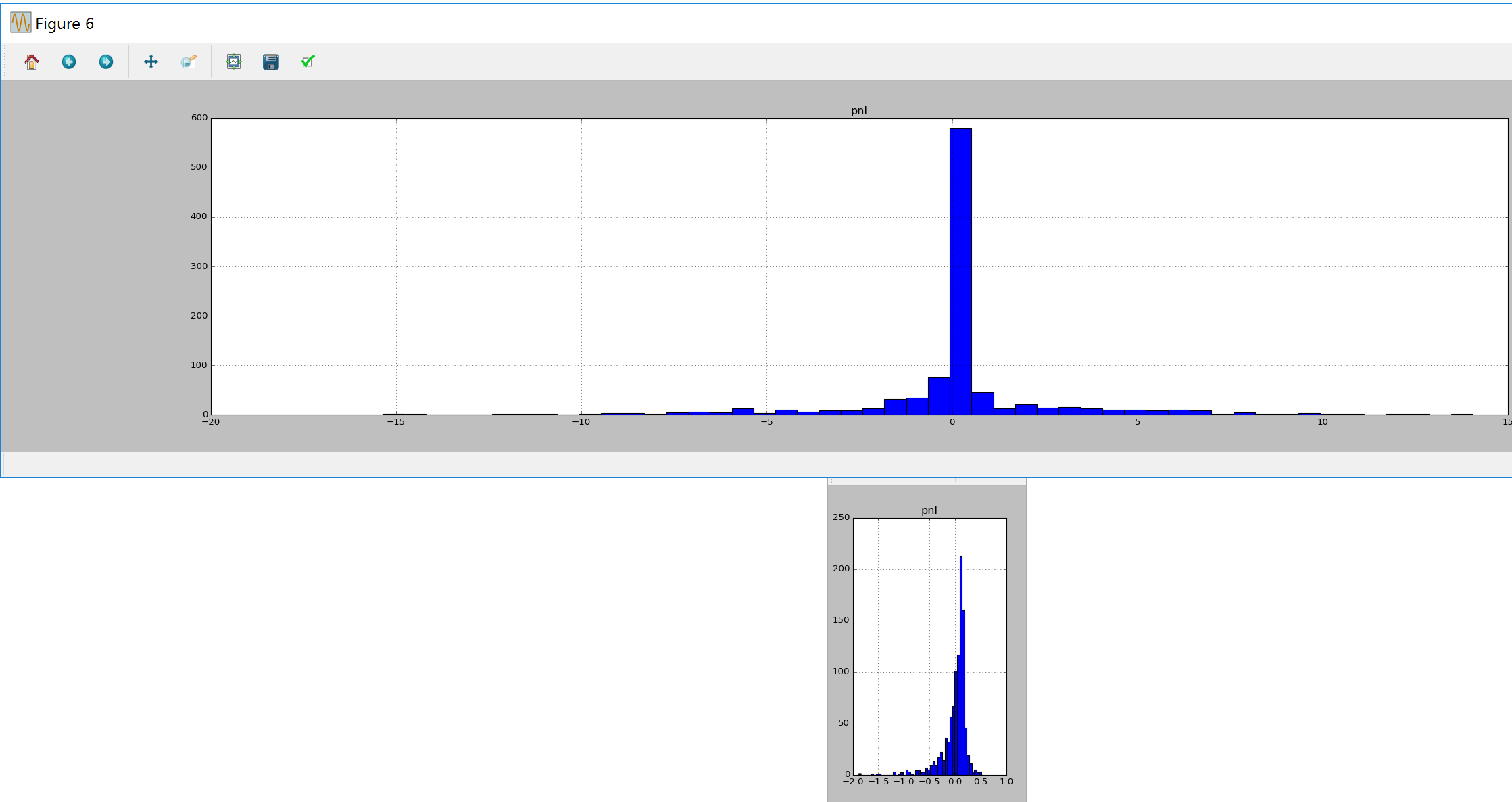

volaility dynamics

here we will run the code first on constant volaility , and then on stochastic implied volaility:

we can see that pnl has much wider distribution in the latter case. this is due to the fact that black sholes assumption does not hold anymore (we would need to hedge with other options to get better pnl profile)

constant vs stochastic volatility pnl delta hedging

import numpy as np

import pandas as pd

pd.set_option('display.width', 320)

pd.set_option('display.max_rows', 100)

pd.options.display.float_format = '{:,.2f}'.format

from scipy.stats import norm

import matplotlib.pyplot as plt

def BlackScholes(tau, S, K, sigma):

d1=np.log(S/K)/sigma/np.sqrt(tau)+0.5*sigma*np.sqrt(tau)

d2=d1-sigma*np.sqrt(tau)

npv=(S*norm.cdf(d1)-K*norm.cdf(d2))

delta=norm.cdf(d1)

gamma=norm.pdf(d1)/(S*sigma*np.sqrt(tau))

vega=S*norm.pdf(d1)*np.sqrt(tau)

theta=-.5*S*norm.pdf(d1)*sigma/np.sqrt(tau)

return {'npv':npv,'delta':delta,'gamma':gamma,'vega':vega,'theta':theta}

class Call(object):

def __init__(self,start,T,K,N):

self.T=T

self.K=K

self.start=start #day to sell option

self.N=N

def calc(self,today,vol,S):

if today<self.start:

return {'delta':0,'npv':0,'vega':0,'gamma':0,'theta':0,'intrinsic':0}

if today>self.T:

return {'delta':0,'npv':0,'vega':0,'gamma':0,'theta':0,'intrinsic':0}

if today==self.T:

return {'delta':0,'npv':0,'vega':0,'gamma':0,'theta':0,'intrinsic':self.N*max(0,S-self.K)}

tau=(self.T-today)/250.

call=BlackScholes(tau, S, self.K, vol)

return {'delta':self.N*call['delta'],'npv':self.N*call['npv'],'vega':self.N*call['vega'],'gamma':self.N*call['gamma'],'theta':self.N*call['theta'],'intrinsic':self.N*max(0,S-self.K)}

def deltahedge(Ndays,Sdynamics="S*=(1.0+vol*np.sqrt(dt)*np.random.randn())",volDynamics="vol=.30"):

S=90.0

Strike=100.0

vol=.30

columns=('spot','vol','shares','cash','option','npv','vega','gamma','theta','pnlPredict')

df = pd.DataFrame([[S,vol,0,0,0,0,0,0,0,0]],columns=columns)

dt=1/250.

cash=0

dayToSellCall=1

maturityCall=Ndays-1

call=Call(dayToSellCall,maturityCall,Strike,-10)# sell one call on dayToSellCall day

for day in xrange(1,Ndays+1):

exec Sdynamics

exec volDynamics

if day==dayToSellCall: #sell call

callValue=call.calc(day,vol,S)

cash-=callValue['npv']

#delta hedge

callValue=call.calc(day,vol,S)

delta=callValue['delta']

currentNumberShares=df.iloc[day-1].shares

sharesBuy=-currentNumberShares-delta

cash-=sharesBuy*S

if day==maturityCall:

cash+=call.calc(day,vol,S)['intrinsic'] #settle call

gamma=callValue['gamma']

theta=callValue['theta']

dS=S-df.iloc[day-1].spot

pnlPredict=0.5*gamma*dS*dS+theta*dt

dfnew=pd.DataFrame([[S,vol,-delta,cash,-callValue['npv'],cash+callValue['npv']-delta*S,callValue['vega'],gamma,theta/250.,pnlPredict]],columns=columns)

df=df.append(dfnew,ignore_index=True)

df['pnl'] = df['npv'] - df['npv'].shift(1)

df['vol']=100.0*df['vol']

df['error']=df['pnl']-df['pnlPredict']

df.set_value(dayToSellCall, "error", 0)

#df.loc[:,['vol','spot']].plot(title='Spot and implied Volatility')

df.loc[:,['npv','spot','option']].plot(title='-Call+delta*S+cash vs Spot {0} {1}'.format(Sdynamics,volDynamics))

df.loc[:,['theta']].plot(title='Theta {0} {1}'.format(Sdynamics,volDynamics))

df.loc[:,['pnl']].hist(bins=50)

#df.loc[:,['error']].hist(bins=50)

print df.loc[:,['pnl']].describe()

#print df

deltahedge(1000)#constant vol

deltahedge(1000,volDynamics="vol*=(1.0+0.5*np.sqrt(dt)*np.random.randn())")#stochastic vol

deltahedge(1000,Sdynamics="S=90") #consant OTM

deltahedge(10000,Sdynamics="S=100") #consant ATM

deltahedge(10000,Sdynamics="S=110")#consant ITM

deltahedge(10000,Sdynamics="S+=S*dt") #growing stock

plt.show()

![[<<] PriceDerivatives blog](http://www.pricederivatives.com/en/wp-content/uploads/2014/03/cropped-pricederivatives-blog-logo-Copy3.png)